Accrual vs. Cash Accounting

-

What Is Cash Accounting?

-

What Is Accrual Accounting?

Accrual vs. Cash Accounting

When it comes to tracking income and

expenses, businesses can choose between two main accounting methods: accrual

accounting and cash accounting.

“The difference between accrual and cash accounting lies in when revenue and expenses are recorded.”

Each method has its own rules and impact on how financial results are reported. Let’s break them down clearly.

“The difference between accrual and cash accounting lies in when revenue and expenses are recorded.”

Each method has its own rules and impact on how financial results are reported. Let’s break them down clearly.

1. What Is Cash Accounting?

In cash accounting, revenue

is recorded only when money is received, and expenses are recorded only

when they are actually paid. This method is straightforward and often used

by small businesses or freelancers.

Example: You send an invoice in June but don’t receive payment until July. Under cash accounting, the income is recorded in July, not June.

Example: You send an invoice in June but don’t receive payment until July. Under cash accounting, the income is recorded in July, not June.

2. What Is Accrual Accounting?

In

cash accounting, revenue is

recorded only when the money is actually received, and expenses are recorded

only when they are paid. This method is straightforward and commonly used by

small businesses or freelancers because it directly reflects the movement of

cash. For example, if you send an invoice to a client in June but receive the

payment in July, the income is recorded in July,

not June. While cash accounting is easy to manage

and effectively tracks real cash flow, it doesn't

show money owed to you or outstanding expenses, which means it

might not give the full picture of your financial situation.

Key Takeaways

✅ Cash accounting is simple and tracks actual money in

and out

✅ Accrual accounting gives a fuller picture of income and expenses

✅ Accrual is better for long-term planning and required for bigger businesses

✅ The method you choose affects how profits and performance are reported

✅ Always be consistent with the method you apply

✅ Accrual accounting gives a fuller picture of income and expenses

✅ Accrual is better for long-term planning and required for bigger businesses

✅ The method you choose affects how profits and performance are reported

✅ Always be consistent with the method you apply

Write your awesome label here.

Access all Accounting and Bookkeeping Courses from One Portal.

Mastering Bookkeeping and Accounting

MBA simplifies accounting, ledger management, account balancing and financial statement preparation.

QuickBooks Online For Bookkeepers

From Beginner to Expert: Master QuickBooks Online. Effortlessly Navigate, Analyze Transactions, and Unlock its Full Potential.

Xero Accounting For Bookkeepers

Learn how to use Xero, the leading online accounting software to perform most of the essential bookkeeping tasks.

ChatGpt for Bookkeepers and Accountants

Learn how to use the ChatGPT prompt toolkit to simplify daily accounting tasks for accountants and bookkeepers instantly.

Subscribe to our newsletter

Stay informed with the latest accounting tips, tools, and updates from Accountutor right in your email inbox.

Thank you!

Policy Pages

Download QuickBooks Online PDF Guide

Thank you!

Download QuickBooks Online Cheat Sheet

Thank you!

Download ABCD of Accounting

Thank you!

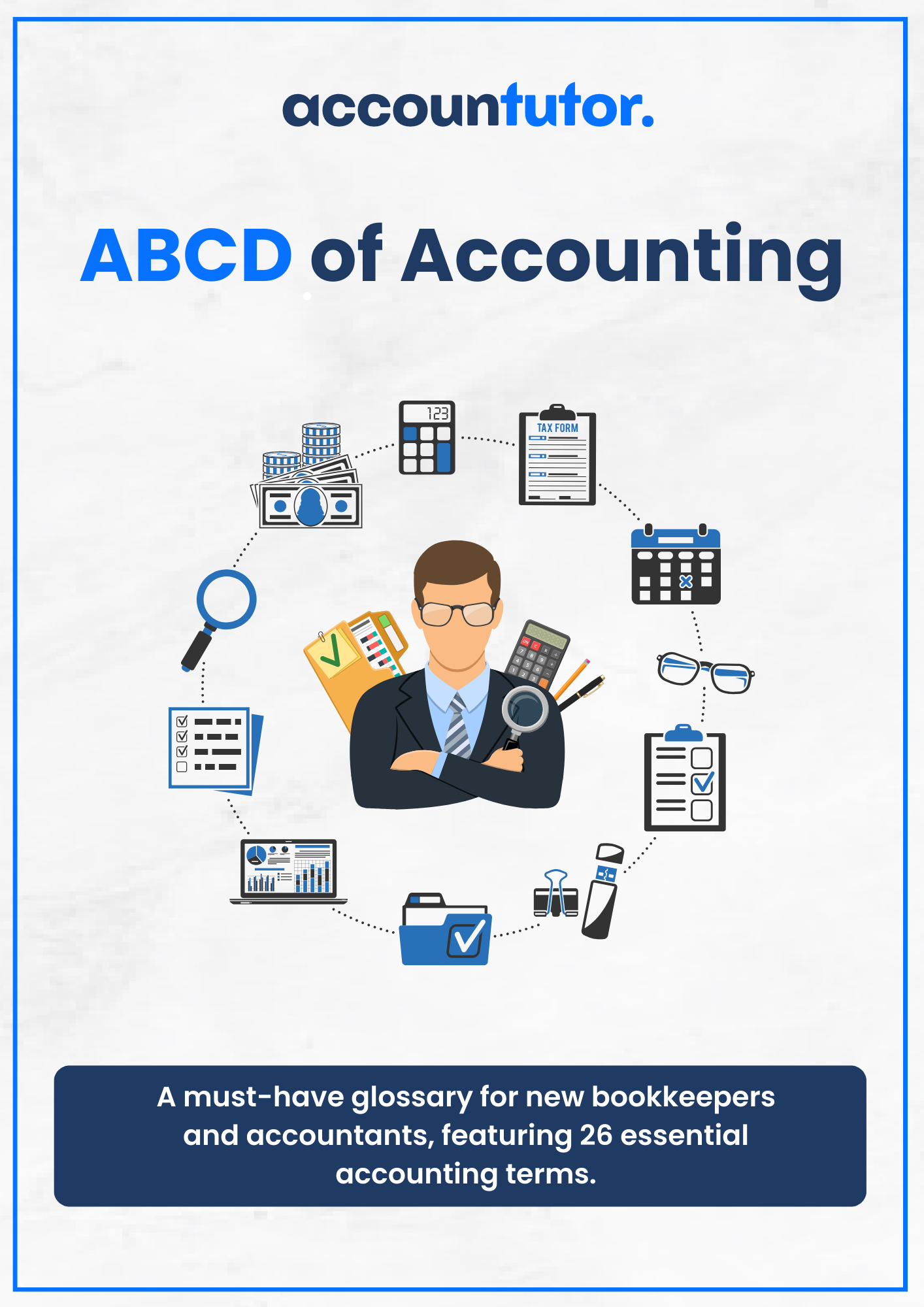

Download Checklist 2024

Thank you!

Register For Free!

Thank you!

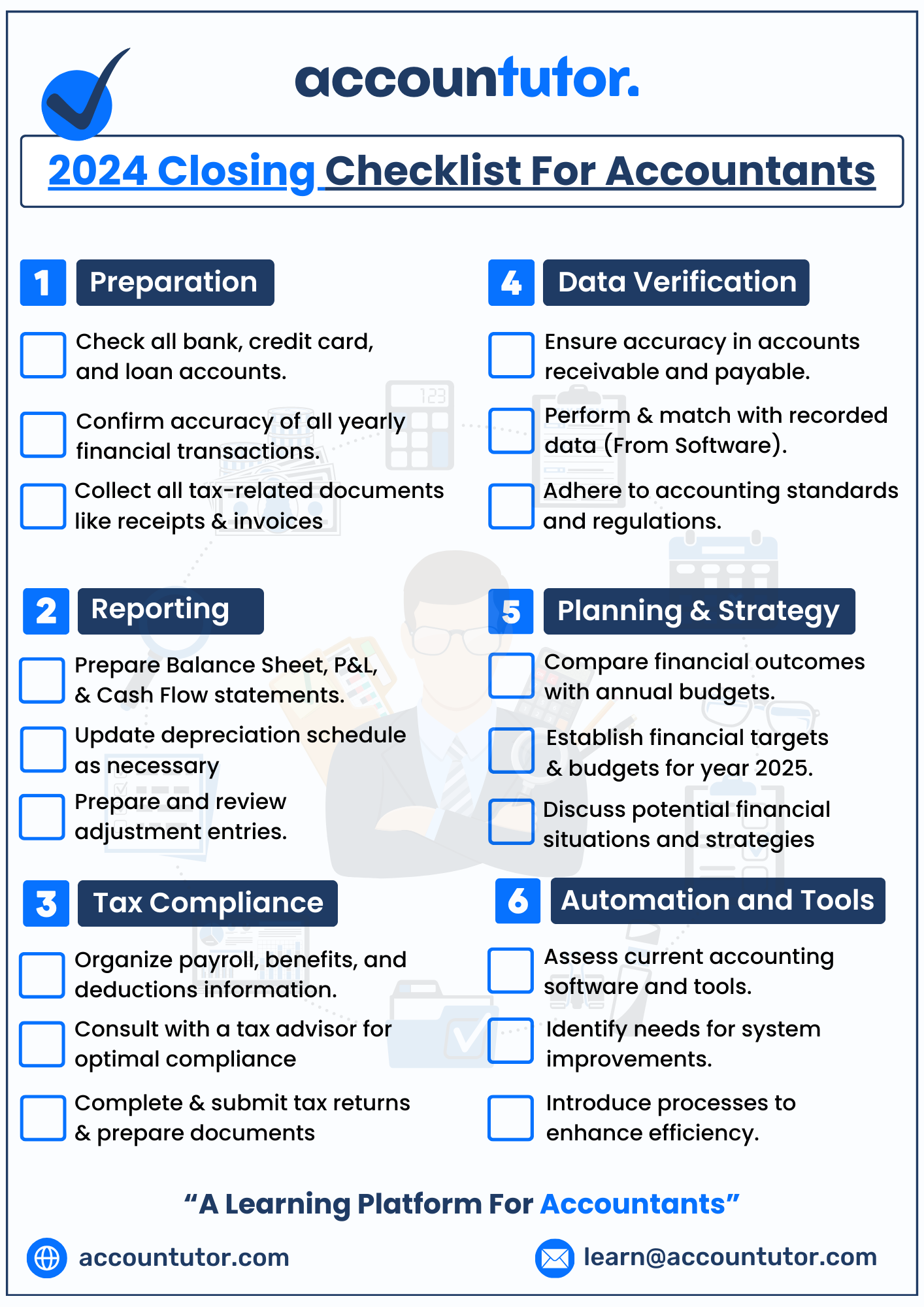

Download Interview Questions

Thank you!